Insights

SK Battery America Project in Georgia Could Be In Jeopardy

As US states ramp up their efforts to take advantage of trends favoring reshoring of overseas manufacturing, it’s important to fully understand and proactively address any underlying issues that could negatively impact the positive elements of a project.

A large battery factory, SK Battery America, that’s being built in Jackson County Georgia involving South Korean company SK Innovation (SK) is at risk as a result of a recent International Trade Commission ruling that SK stole trade secrets from rival LG Energy Solution.

In many instances, clear communication and proactive collaboration can prevent unpleasant surprises. The North America Closeshoring team and our affiliates have vast experience dealing with these types of issues, particularly involving relationships between US states and companies from South Korea, Taiwan, Japan, China and India.

The good news is that most of the time, even after court rulings, adverse situations can be resolved in a manner that preserves projects. But, it’s always better to preempt a dispute before it escalates to formal proceedings.

Reshoring Pharmaceutical Manufacturing to the USA – We Can Do It!

According to the FDA, at least 72% of drugs used in the USA are manufactured abroad. As demonstrated by recent negative consequences resulting from the COVID-19 pandemic, the risks of offshoring likely surpass the benefits. Moreover, other supply chain issues, such as geopolitical conflicts, brand damage, and intellectual property theft are significant risks that weigh against manufacturing pharmaceuticals in distant countries.

Because of pandemic related issues and advances in technology, it is now likely that a reshoring innovation and supply chain strategy can be successfully implemented in North America for any pharmaceutical product. A viable US business model for pharmaceutical manufacturing depends upon the ability to utilize technological innovations and modern supply chains. A reshoring strategy can be successful in North America, not only in the short term because supporting government policies are now in place, but also in the long term, because supporting technology and supply chain sustainability will increase profitability.

Due to the efforts of C-SOPS based at Rutgers University, the Massachusetts Institute of Technology, the National Science Foundation, FDA, and leading US-based pharmaceutical companies, such as Janssen, Vertex, Pfizer, and Eli Lilly, now is the time to begin the movement of pharmaceutical manufacturing back to North America.

https://www.pharmtech.com/view/reshoring-pharmaceutical-manufacturing-to-the-us-can-we-do-it

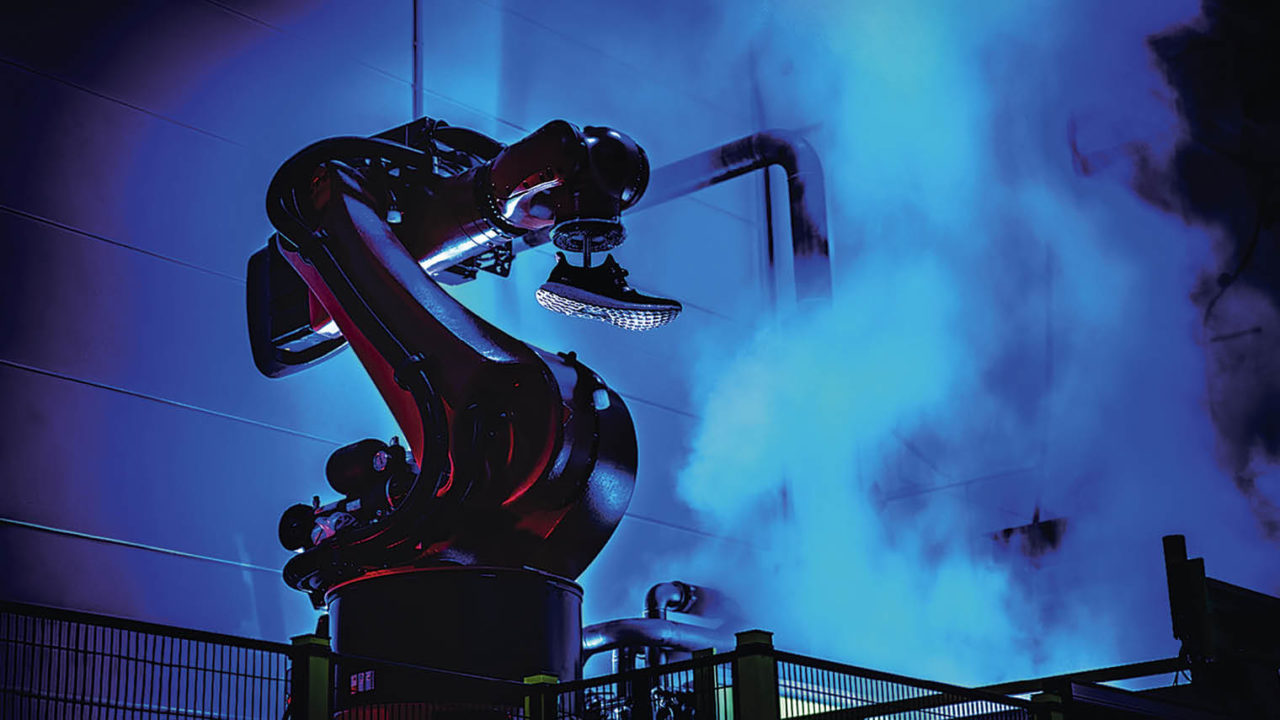

Digital Tools Will Eliminate Many Barriers to Reshoring

The trend of reshoring manufacturing from distant international locations back to North America can be accelerated by use of digital tools that are easy-to-use, quick, and cybersecure, to identify resources, automate manufacturing, locate supply chain ecosystems, and develop logistics efficiencies.

North America Closeshoring and their technology partners are developing tools to help companies determine, in advance, the best locations for reshoring and how to save money and increase profits by incorporating some automation. In essence, these tools work in a Google-like manner to produce information that enables straightforward and highly effective ways to significantly reduce the barriers and enhance the success of reshoring.

Taking Supply Chains Out of the Dark Ages

A recent PricewaterhouseCoopers report anticipated that companies would have to address the implications of their supply chains in regions affected by the coronavirus. In addition to localizing and digitizing supply chains, companies might have to secure redundant transportation options and buy ahead to procure much-needed inventory and raw materials.

Tech startup Verusen claims it can help businesses save an average of $10 million within a three-month period, with clients including Georgia Pacific, Graphic Packaging, and AB InBev. “As supply chains start on their digital transformations, we help them better understand their disparate and incomplete data and connect it to trusted business outcomes from the very start,” said Verusen founder and CEO Paul Noble.

Gartner says that by 2023 at least 50% of large global companies will be using AI, advanced analytics, and internet of things technologies in supply chain operations. Meanwhile, McKinsey & Company estimates companies that “aggressively” digitize their supply chains can expect to boost annual interest, tax, depreciation, and amortization (EBITDA) growth by 3.2% and annual revenue growth by 2.3%.

Verusen raises $8 million to reconcile supply chain data using AI

Market Demand Leads To Chip Factory Expansion In the US

Unprecedented demand exists for semiconductor chips, fueled by 5G smartphones, modern vehicles, next-generation video game consoles, cloud computing and artificial intelligence systems. Geopolitical risks and rivalries involving China and Taiwan threaten Taiwan’s chipmaker TSMC.

These factors have led to a chip shortage and changes to the global semiconductor supply chain that involve construction of massive new chip factories in the U.S. In response to these factors, TSMC is establishing a $12 billion chip fabrication plant in Arizona. South Korea’s Samsung Electronics Co. is set to follow, with construction of a $10 billion chip manufacturing facility in Austin, Texas.

The “CHIPS for America Act” introduced to Congress last year aims to encourage the establishment of more U.S. plants. U.S. Rep. Michael McCaul, a Texas Republican, plans to reintroduce the bipartisan bill this year with a view to securing $25 billion in federal funds and tax incentives. McCaul said in a statement he’s working with colleagues in the House and Senate “to prioritize getting the remaining provisions of CHIPS signed into law as quickly as possible.”

Contact Us