Insights

Decarbonization Will Be a Key Driver of Growth and Healthy Prosperity

A major shift has occurred throughout industry and decarbonization is now a high priority. This shift has occurred, in part, due to the rapid decrease in the cost of renewable energy, as compared to traditional energy. Other factors motivating the shift include the rise of ESG principles, investor pressure on public companies, and costly disruptive risks within supply chains.

Decarbonization is now the greatest opportunity for global economic growth, sustainability and prosperity. The current view of business leaders, financial institutions, insurers, investors and policy makers is that there is a lucrative approach to rapidly deploy clean and relatively inexpensive technologies that significantly reduce carbon and other greenhouse gas (GHG) emissions.

Recent reports such as The Renewable Spring show that a rapid industrial clean-energy transition will stimulate exponential growth and create massive benefits similar to past industrial revolutions. Decarbonization is already attracting significant private capital and building momentum. Policy makers are doing their part to enable legislative frameworks and funding.

The truth is that trillions of dollars will be saved and additional trillions will be made as a result of decarbonization. All of this will occur while creating a healthier planet for us, our children and future generations. This process might turn out to be the greatest win-win in history.

Nordic Companies Are Some of the Most Innovative in the World

The Nordic countries (Sweden, Finland, Denmark, Norway and Iceland) consistently rank among the most entrepreneurial and business-friendly nations in the world.

Nordic life celebrates the individual and these countries value a capitalistic system that is centered around innovation. People from Nordic countries have a high level of education that focuses from a young age on problem-solving and critical thinking. Most people are multilingual and in recent years, the region has topped the global happiness rankings done by the UN Sustainable Development Solutions Network.

Examples of well-known companies that started in the Nordic countries include: Lego, Spotify, IKEA, Oatly, Ericsson, Volvo, Vestas, ABB, Maersk, Electrolux, Kone, Carlsberg, Takeda Pharma, Novo Nordisk, H&M, and Icelandair.

Many companies from outside this region test new products and concepts in these countries before the most promising ones are rolled out into larger markets, like the UK, Germany and the US.

A few examples of companies from this region that have expanded to the US are Einride, Klarna, and Local Greens USA. Einride is a Swedish electric autonomous freight company that is working with Coca-Cola, Oatly, Lidl, Electrolux and others. Klarna is a Swedish fintech company that provides online financial services,including online storefronts, direct payments and post-purchase payments. Local Greens USA is a Finnish indoor farming company.

Railroads Are On the Forefront of Reducing Carbon Emissions

When it comes to fixing broken supply chains and improving the environment, railroads could be a key piece of the puzzle. Compared to other modes of transportation, such as trucks, railroads are lower emitters of carbon and other greenhouse gases. Diesel is currently the primary fuel used by U.S. freight railroads in their locomotives and new technologies such as fuel management software, start-stop procedures and Tier 4 locomotives have been implemented by many railroads to reduce emissions.

In 2025, the U.S. EPA Tier 5 standard and the European Euro7 standard are scheduled come into effect. Both standards limit the emission of harmful substances by trains and locomotives to very low values. These new standards require zero particulate matter emissions and almost zero nitrogen oxide emissions.

Also during this decade, it’s expected that implementation of new rail transportation technologies could completely eliminate emissions, such as adoption of battery-electric and hydrogen fuel cell locomotives.

Wabtec is working with Carnegie Mellon University and BNSF to test a battery-electric locomotive. Alstom, Cummins, Siemens and other companies have demonstrated the viability of hydrogen fuel cell passenger locomotives in Europe.

Regardless of politics and ideologies, clean forms of energy and transportation make sense and actually save money while benefitting the environment and enhancing supply chain efficiencies.

Love Them or Hate Them, Autonomous Trucks Are Here

Broad adoption of fully autonomous vehicles has been anticipated for years, but the reality has been more challenging.

Yet, we all experience autonomous transportation (airport trains and autopilot flying) every time we go to the airport a fly on a plane.

What is the future when it comes to full automation of cars and trucks? Almost every new car has some autonomous technology, but fully autonomous cars are highly complex, will require further development of technology and probably will not broadly exist until the 2030’s.

Autonomous trucking and freight movement will arrive before the end of this decade because freight movement can be restricted to specific roads, origins, destinations and time of travel. Driver shortages, supply chain challenges, decarbonization and increasing operating costs also favor a shift to electric, autonomous freight. Companies such as Einride, TuSimple, Embark, Daimler, Tesla, Volvo, Waymo, Kodiak, Nuro, Gatik, and Plus are all pilot testing autonomous trucking/freight technology.

Einride stands out from all these companies and may ultimately be the big winner because of its electric driverless PODs that have no cabs and remote human driver assistance. Einride is already moving freight on public roads in Sweden for some of the biggest global brands: Electrolux, Oatley, Coca Cola and Lidl supermarkets. Einride is in the process of entering the US market, so don’t be surprised when you soon see Einride PODs on US roads.

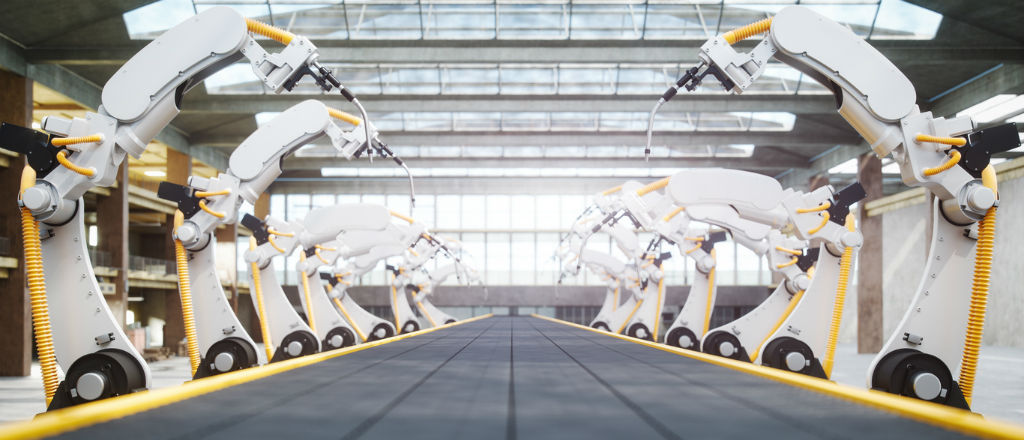

A Trillion Dollar Opportunity For US Manufacturing

Why have tariffs, tax credits, comparatively low energy costs and increasing use of automation not had more of an impact on increasing American manufacturing?

The answer is found in what’s called the manufacturing gap, where the US publicly and privately financially supports basic research to create new technology but fails to financially support commercialization. Development stage companies in the US often struggle to borrow or raise the money needed to finance a new factory, particularly when those loans or investments can take many years to pay off.

The good news is that there is bipartisan support to solve this problem. Republican Senator Marco Rubio and moderate Democratic senators, led by Senator Chris Coons of Delaware, have proposed creating an Industrial Finance Corporation (IFC) that would fill the manufacturing gap and finance high-tech production nationwide.

The IFC would make long-term loans, own equity, and guarantee purchases for emerging companies, so they could commercialize their technology and products. Creating the IFC will support growth of a trillion dollar US ecosystem for industries of the future.

It must be done!

Contact Us